A solid horse racing trading strategy could help you earn up to £200 tax-free daily. You can achieve this by making just a £10 profit consistently across several races.

The Betfair horse racing exchange offers 15-40 races every day, which creates plenty of opportunities. Most betting activity happens in the final minutes before each race starts – about 90% of all money gets matched during this time. This creates ideal conditions for profitable trading. Horse racing betting strategies differ from traditional betting because they focus on price movements instead of picking winners.

You’ll find different approaches that match your style. Some traders prefer low-risk scalping for quick, small profits, while others choose swing trading to benefit from bigger price movements in volatile markets. These methods could provide you with a steady second income or lead to full-time trading if you maintain discipline and execute properly.

Let me show you the best horse racing trading strategies on Betfair. You’ll discover which approach fits your personality, schedule, and financial goals best. Ready to become a profitable horse racing trader?

Why Trade Horse Racing on Betfair?

Betfair horse racing markets have become one of the best ways to make steady profits from sports markets. The exchange gives you advantages that regular bookmakers can’t match. Let’s get into why horse racing on Betfair creates such amazing chances to profit.

High volume of daily races

The number of racing options creates a perfect playground for traders. You’ll find 15-40 races every day, and even small profits add up fast into big earnings. This steady stream lets traders pick and choose their best races.

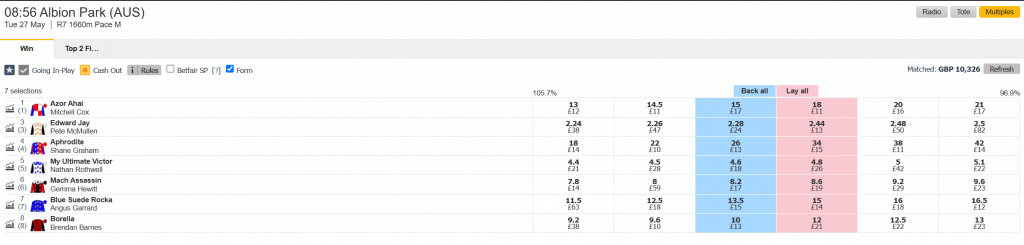

Betfair’s horse racing markets match about £500,000 per race in the UK. The big deal is that 90% of all betting money gets matched just minutes before the race starts. This rush of activity creates the perfect setting for traders who love market swings and price changes.

The final betting show happens in the last 10 minutes before race time. The market heats up fast during this time, giving you the best shot at making your trades work. Your profit potential goes up when you zero in on this short window.

Each race has its own personality. Smaller races show bigger price swings because of lower volume. Big events at Cheltenham or Royal Ascot can see up to £5 million matched. These differences let traders use different approaches.

Scalability and repeatability of profits

The best part about horse racing trading is turning small wins into bigger ones across many races. Making £10 per race adds up fast when you have dozens of chances each day. Traders can fine-tune their approach with this regular practice.

There are some practical limits to scaling up. Here’s what you need to know:

- £50 stakes work in most markets

- Moving up to £100-£250 gets trickier in regular racing

- The season matters – summer racing draws more money than winter all-weather meets

Success comes from treating each race differently. Unlike betting, where you need winners, trading lets you cut losses fast and maximise profits when you’re right.

The horse racing market’s structure gives traders an extra edge. The Betfair odds system has “crossover points” (around 4.0-4.1) where risk drops below potential reward. Knowing these market sweet spots gives traders built-in advantages.

Finding good trades isn’t the hard part. The challenge lies in growing your stake size while keeping risk in check. Smart traders know that race types, time of day, and seasons all affect their strategy choices.

Difference between betting and trading

Betting is all about picking winners. You place your bet, wait, and either win or lose everything. Trading focuses on price movements before or during races, and the winner doesn’t matter.

“Betting exchanges such as Betfair have revolutionised betting due to the way they operate,” with prices that beat traditional bookmakers. The exchange lets users ask for better odds or lay selections, opening up possibilities you won’t find with regular bookmakers.

Trading gives you mental advantages over betting. While gamblers ride the rollercoaster of big losses and occasional wins, successful traders see steadier results. This stability helps many people stick with trading long-term.

Risk management works better in trading. Here’s why:

- You can get out before the race ends

- You risk less of your stake at once

- One stake works multiple times in a session

- You can stop losses quickly when things go wrong

Trading doesn’t need you to pick winners – you just need to spot market inefficiencies and price moves. This key difference means you can make money no matter which horse wins, as long as you trade right.

Horse racing trading on Betfair gives you a smarter way to profit from racing markets. Understanding market dynamics instead of just picking winners puts you ahead of regular punters.

Scalping: The Easiest Way to Start

Scalping is the most available way to start your experience in horse racing trading. This technique helps you profit from small price movements instead of predicting race outcomes. You just need basic market knowledge, but you must execute trades with discipline to succeed.

How scalping works on Betfair

You make money by placing two opposing bets (back and lay) on the same selection at slightly different prices. The goal is to capture a 1-5 “ticks” difference in price – a tick is one increment in betting odds.

Let me give you an example. You back a horse at 3.25 odds and lay it at 3.20. This locks in a small profit, whatever the race outcome. Each trade might only net around £3, but these profits add up fast when you repeat the process in different races.

The process is simple. Place your first bet at the current market price and wait for a match. Then place the opposing bet at a better price right away. You can “green up” your position after that to ensure equal profit, no matter which horse wins.

Yes, it is about exploiting brief market inefficiencies rather than picking winners. A seasoned trader puts it well: “Out of all the horse racing trading strategies that I use, scalping has long been my favoured approach. Consistently turning a small profit adds up fast and doesn’t require a large bankroll”.

When to scalp and when to avoid

Timing plays a vital role in successful scalping. The best window is 1-7 minutes before race start. The sweet spot lies in that 4-3 minute period. A “tidal wave of money” flows into the market then, creating ideal conditions with lower risk and better fill rates.

We look for races with these features:

- High-quality races with decent prize money

- Competitive fields with no clear favourite

- Markets with strong liquidity on both sides

- Handicaps, listed, and graded races that tend to have stable prices

Stay away from scalping when you see:

- More than 10 minutes before race start (insufficient liquidity)

- Maiden and novice races (typically volatile)

- Low-quality betting races with unpredictable price movements

- Markets with sharp price movements or imbalanced liquidity

A trading expert warns: “Attempting to scalp 10 or 20 minutes before the start of a horse race is just plain daft. It doesn’t work”. The market lacks enough activity during these early periods.

Common mistakes in scalping

Even the pros make mistakes when scalping horse racing markets. These pitfalls can cost you money:

- Over-trading – Trading too much or forcing trades in poor conditions can hurt you badly. “Everyone with experience knows that over-trading is always difficult. But experienced traders know how important it is to avoid”.

- Poor timing – Scalping in markets with low liquidity or high volatility creates unnecessary risk. Beginners often jump in too early before enough money enters the market.

- Emotional reactions – Quick market changes can wipe out your profits in seconds if you hesitate or react emotionally. “Sudden changes in the market can mean several profitable trades are wiped out in seconds”.

- Chasing losses – Traders often try to recover losses right away instead of waiting for the right conditions.

- Scalping everything – Not every race works for scalping. “The very fact we don’t have to trade everything is an advantage”.

Your success with scalping depends on discipline and execution. Focus on quality opportunities, keep emotions in check, and understand market dynamics. This approach will help you build consistent profits through this available trading method.

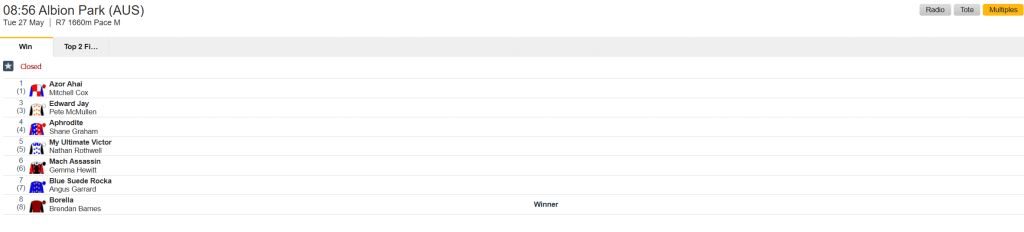

Back-to-Lay: Profiting from Fast Starters

Back-to-lay trading offers some of the most profitable opportunities in horse racing markets, unlike scalping, which targets small price movements. This strategy lets traders back a horse at higher odds before the race and lay it at lower odds during the race. Traders make money from price changes rather than picking winners. Expert traders say it’s “much easier to pick a horse that will lead than to choose the outright winner”.

Identifying front-running horses

TV coverage naturally focuses on front-running horses, which often causes the market to overreact. One expert puts it well: “It amazes me how the market still spasms into a frenzy when a horse bolts off ahead at the start”. Smart traders can profit from these predictable market reactions.

Several key signs help spot potential front-runners:

- Running style and personality: Some horses just love to lead—you can see their excitement as they come onto the course

- Pace figures: Horses with negative numbers (around 9) in pace ratings tend to lead races

- Jockey intentions: Jockeys sometimes push for the lead as part of their race strategy

- Race videos: Past races show if a horse consistently runs in front

The race type makes a big difference. A six-furlong novice on all-weather creates different opportunities than a three-mile jumps race. Jump racing often gives clearer hints about the horse and jockey’s plans near the start time.

Using historical data for selection

Good data drives successful back-to-lay selection. Tools like Racing Alerts on GG.co.uk let you flag specific horses and get email alerts when they race again. Patternform pace cards make it easy to see running patterns from previous races.

Past in-running prices tell an important story. Timeform shows these historical prices, which helps find horses that usually trade lower during races. The best candidates have traded at 50% of their starting price at least 80% of the time in their last five races.

Sporting Life provides detailed race analysis to research past performances. Q-Speed Figures in official programs show how fast horses ran before, which helps compare potential selections.

Managing risk in back-to-lay trades

Smart risk management starts with clear profit goals. Many successful traders aim to lay at 60-65% of their back price. While laying at half the back price sounds great, finding horses that reliably drop that much isn’t easy.

Planning helps avoid rushed decisions. Ask yourself these questions before the race:

- Should I change plans if my horse seems unmotivated at the start?

- What if other horses look too eager?

- How should I react if the horse leads but prices stay flat?

Getting your entry timing right matters a lot. Don’t put all your money down the night before or early morning. Watch the market 30 minutes before the race to spot price patterns, then back the horse when its price peaks.

Stay flexible if things change. Multiple front-runners in a race reduce the edge since they might hurt each other’s chances. Note that “we’re relying on the market contracting in price because the horse has a distinct advantage then”.

Swing Trading: Catching Bigger Price Moves

Swing trading sets apart serious traders from casual participants in horse racing markets. This approach aims to capture substantial price movements that typically seek a 5-10 tick profit per trade or sometimes even more. Unlike quick-fire scalping, you need patience, analysis, and discipline to maximise your returns.

What makes a good swing trade

The core of swing trading involves identifying long-term trends and playing within them. Successful swing trades happen more often if you predict major price swings before they occur. A trading expert explains that swing trading on Betfair is “the process of backing and laying a specific outcome at significantly different prices for an above-average profit”.

You’ll find ideal swing trading chances by spotting price gaps that look ready to correct themselves. To cite an instance, short prices on both first and second favourites often trigger opposite moves in each other. These relationships create patterns you can use to your advantage.

Market volatility creates the foundation for swing trades. Some volatility helps create trading chances. You’ll see these conditions naturally emerge during a race card due to market inefficiencies, especially as bigger money enters the market close to race time.

Swing trading comes with its own set of challenges. Odds rarely move in straight lines. Prices often bounce against your position before moving in their intended direction. You need experience and market knowledge to handle this psychological challenge.

Best race types for swing trading

Certain races create better conditions for swing trading than others. Expert sources point to these specific types:

- Maiden races and sellers show more volatility, which creates ideal conditions

- Races with smaller fields focus money on fewer horses, which increases price movements

- Markets with clear price trends give you better swing trading chances

- Races that show “market movers“ (horses whose odds expand or contract by a lot) offer excellent entry points

Volume plays a crucial role. To cite an instance, a St. Leger meeting might see £600,000 matched compared to just £12,500 at a smaller meeting. Higher volume naturally creates more sustained price movements that suit swing trading.

Featured races in the racing schedule deserve your attention. These “decent betting heats” usually turn into “decent trading heats”. Betting interest and trading chances go hand in hand consistently.

Letting profits run vs. cutting losses

The psychological discipline makes swing trading truly challenging. New traders often close profitable trades too early while holding onto losing positions too long. Breaking this habit becomes key to making profits.

Smart swing traders think ahead and stay patient through price changes. They know that “sitting in a swing trade while it bounces against you isn’t a great feeling”, but keep their discipline throughout. Setting clear exit targets before entering trades helps avoid emotional choices.

Your success depends on risk management. Swing trading can lead to bigger losses than scalping’s one or two tick losses. Waiting for prices to turn around in bad trades might cost you significantly more relative to your stake.

Experienced traders follow the stock market wisdom to “cut your losses and let your profits run”. Swing trading might give you fewer winning trades than scalping, but larger profits from good trades make up for frequent small losses, if you exit poor positions quickly.

Swing trading gives you the best return-to-stake ratio possible with proper execution. It needs more market understanding than scalping, but it offers scaling potential that makes it worth learning as part of your complete horse racing trading strategy.

Avoiding Over-Trading and Emotional Mistakes

Your ability to control emotions is the lifeblood of profitable horse racing trading. Even the best horse racing trading strategy will fail if you can’t control psychological impulses that guide you to over-trade. Understanding these pitfalls can protect your trading bank from losses you don’t need.

Signs you are over-trading

The most obvious sign of over-trading shows up when you place trades without clear reasoning. You might find yourself entering markets just to “be involved” instead of spotting a genuine chance. There’s another reason to watch out – the constant urge to recover losses right after they happen makes you take bad decisions.

People who over-trade usually can’t accept small losses. They let negative positions run, hoping things will turn around. This creates a tough situation because you need many more winning trades just to break even. Without a doubt, you’re showing problematic behaviour if you keep checking your trading platform when no clear chances exist.

Types of over-traders

Trading behaviour patterns reveal several distinct over-trader profiles:

- Technical Over-Traders: These traders find chart-based reasons after they’ve already placed trades, instead of letting market flow guide their choices.

- Trigger-Happy Over-Traders: You’ll spot them opening and closing positions often due to self-doubt, especially after poor results.

- Shotgun Over-Traders: These traders try handling too many markets at once, spreading themselves too thin to make any strategy work.

How to stay disciplined

You need solid strategies to stay disciplined. Start by speaking your trading plan out loud before you execute – this makes it harder to drift from your strategy. A detailed trading diary helps hold you accountable when you review decisions.

Regular breaks become crucial, especially when you have strong emotions. The “red mist” usually shows up after hours at the screen as small frustrations build up. Set clear time limits for your trading sessions.

Note that successful “cold traders” work with minimal emotional attachment. They read market trends instead of forming opinions about horses. Discipline remains your key to trading profitably.

Choosing the Best Horse Racing Trading Strategy for You

You’ll need an honest look at yourself to find the right horse racing trading strategy that works for you. The Betfair horse racing exchange doesn’t have a one-size-fits-all approach. A strategy that helps one trader make consistent profits might leave another struggling to get anywhere.

Matching strategy to your personality

Your natural traits should guide how you pick your trading style. Scalping might be your best fit if you thrive under pressure and make quick decisions. But if you like stability and longer timeframes, swing trading could match your style better.

Your risk tolerance level is a vital factor to think about:

- High risk tolerance: Feel good with dynamic conditions? Scalping lets you jump in and out quickly if you have fast reflexes

- Medium risk tolerance: Day trading gives you decent stability while you still make several decisions each session

- Low risk tolerance: Swing trading cuts down on quick market change stress and lets you focus on bigger trends

The way you handle patience plays a big role in your trading success. Traders who lack patience often get frustrated with swing trading as positions take days to develop. Those who can wait patiently tend to do well as trades come together.

Bankroll and time considerations

Your starting bankroll should be 20-50 times your per-bet stake. This will give you enough cushion during those inevitable losing streaks. Most beginners do fine with a few hundred pounds if they size their stakes right.

Your staking plans need to match how you trade. While percentage staking looks good at first, seasoned traders know that stake size should depend on how good the opportunity is, not your bank balance. Here’s something practical: trading £200 at 3.5 odds risks about £3 per tick, while the same stake at 10.0+ puts about £10 per tick at risk.

When to switch or combine strategies

Results tell you the truth about how well your strategy works. “You know when your strategy isn’t working,” and market signals become clear when you keep entering positions only to watch odds move against you.

It makes sense to move to a different strategy when your life changes. New jobs or family responsibilities often mean you need to adapt your approach. The market conditions also just need different approaches – a class 1 handicap at a major festival creates stable markets that work great for scalping. Maiden races with limited information create choppy conditions that suit swing trading better.

Note that a strategy that fails for one trader might be perfect for someone else. Your profit/loss screen will always be the final judge of how well your strategy works.

Final Thoughts on Becoming Skilled at Horse Racing Trading

Horse racing market trading gives you a clear edge over traditional betting methods. These strategies can reshape the scene of your Betfair horse racing market approach.

Your success in horse racing trading depends on picking strategies that match your personality, risk tolerance, and schedule. Quick decision-makers might excel at scalping. Back-to-lay trading works best for traders who can spot front-runners. Patient traders often prefer swing trading to capture major price shifts.

Without doubt, trading psychology matters just as much as technical knowledge. Traders with discipline who avoid emotional decisions and excessive trading perform better than those with great technical skills but poor emotional control.

You should start with small stakes to understand market dynamics without putting too much capital at risk. A detailed trade log helps you spot patterns in winning and losing positions. Profitable trading comes from steady improvement, not from chasing a perfect strategy that doesn’t exist.

Master one strategy before you add more to your toolkit. Your foundation should stay the same whether you want to make £50-100 daily or become a full-time trader. Focus on consistent execution, solid risk management, and emotional discipline.

Note that even seasoned traders have losing days. Learning horse racing trading takes dedication. The rewards make it worthwhile for those ready to put in the time – you can earn consistent tax-free profits regardless of race outcomes.

Your Horse Racing Trading FAQs

Q1. What is the most effective horse racing trading strategy on Betfair? There’s no single most effective strategy, as it depends on your personality and risk tolerance. Scalping suits quick decision-makers, back-to-lay trading works well for those who can identify front-runners, and swing trading is ideal for patient traders looking to capture significant price movements.

Q2. How much money do I need to start trading horse racing on Betfair? For most beginners, a starting bankroll of a couple of hundred pounds is sufficient. It’s recommended to have at least 20-50 times your per-bet stake to ensure you don’t deplete your funds during inevitable losing streaks.

Q3. Can I make a full-time income from Betfair horse racing trading? While some traders do make a full-time income, it’s important to understand that Betfair trading is not a get-rich-quick scheme. It requires hard work, dedication, and a deep understanding of sports and betting markets. Many traders start with it as a side hustle to supplement their income.

Q4. How can I avoid over-trading in horse racing markets? To avoid over-trading, only place trades with clear reasoning, not just to “be involved.” Set clear time limits for your trading sessions, take regular breaks, and maintain a detailed trading diary. Remember that discipline is the most critical factor in trading profitability.

Q5. What’s the difference between betting and trading on horse racing? Betting focuses on predicting race outcomes, while trading centres on exploiting price movements before or during an event, regardless of the final result. Trading offers more control over risk management, as you can exit positions before the race ends, and only a portion of your stake is typically at risk at any time.