What Is Arbitrage Betting? Arbing or arbitrage betting is a trading method used on betting exchanges that guarantees a profit by taking advantage of pricing disparities in the market.

Arbitrage Betting Explained

Arbitrage is a trading technique that benefits from price differences between two betting markets to guarantee a profit regardless of the outcome of the sporting event.

Arbitrage is a common technique used by stock market traders, This is when a trader guarantees a profit by buying stock for one price on one exchange and selling the same stock for a higher price on another.

The same principle applies to betting on sports with a betting exchange. You are essentially betting on all outcomes of an event, so for a football match, you are backing the home win, the draw, and the away win all at once.

You can do so by placing bets at one price and then laying that same bet for less liability than the profit of the initial bet.

Market Efficiency And Arbitrage Betting Opportunities

Market efficiency is a fundamental concept in finance and economics, crucial for understanding arbitrage betting. It refers to how well market prices reflect all available information. The more efficient a market is, the quicker and more accurately prices adjust to new information. In an efficient market, arbitrage opportunities—profiting from price discrepancies—are rare and short-lived.

The Role of Information in Market Efficiency

This is how information can affect a market and its efficiency, it also affects the chance of a successful arbitrage opportunity coming your way.

Information Accuracy and Access

Information is the lifeblood of any market. Accurate and timely information ensures that market prices reflect true value. If every participant had access to perfect information, markets would be perfectly efficient. However, this is an ideal state that doesn’t exist in reality. The quality of information and who has access to it vary widely, leading to varying degrees of market efficiency.

Speed of Information Dissemination

The speed at which information is disseminated and acted upon also affects market efficiency. Faster dissemination and processing of information lead to quicker adjustments in prices, thereby enhancing market efficiency. Conversely, delays in information flow create opportunities for arbitrage as prices lag behind the true value.

Factors Contributing to Market Inefficiency

No market is perfectly efficient. Several factors contribute to market inefficiency, including:

- Information Asymmetry: Not all market participants have access to the same information simultaneously.

- Differing Interpretation: Even with the same information, different participants may interpret it differently, leading to varied reactions.

- Timing Disparities: The speed at which participants act on information can vary, causing temporary price discrepancies.

How Arbitrage Betting Exploits Inefficiencies

Arbitrage betting leverages these inefficiencies to secure risk-free profits. When discrepancies arise between different betting markets, arbitrage bettors place bets on all possible outcomes to guarantee a profit regardless of the result. This process relies heavily on identifying and acting upon market inefficiencies before they are corrected.

Sports Betting Markets

In sports betting, market inefficiencies often arise from the rapid flow of information about player injuries, weather conditions, and team strategies. Betting odds can vary significantly between bookmakers, especially in rapidly changing scenarios. Savvy bettors who monitor these changes can exploit the differences for arbitrage opportunities.

Financial Markets

Similarly, in financial markets, stock prices may not instantly reflect new earnings reports, geopolitical events, or economic data. Traders with faster access to this information or superior analytical tools can capitalise on these short-term discrepancies.

How To Place An Arbitrage Bet

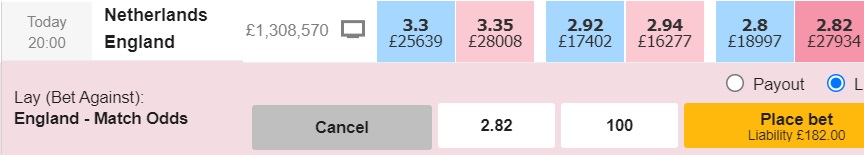

Firstly find your chosen betting market. For this example, we are going to use the England Vs Netherlands Match in Euro 2024.

We need to find a market that is at a higher price at a bookmaker than on the exchange (not an easy task), but for example, let’s say we find the odds of 3/1 on England to win at SkyBet.

We place a £100 bet with Skybet at 3/1, meaning our return if England wins is £400 (£300 profit).

We now go over to Betfair and find that we can Lay this bet (the opposite of backing) with a liability of £182, so we take our profit if this bet wins £300 and take away the liability of the lay bet if England wins of £182 and we are left with £118.

So we have a risk-free bet on the England game, but we want to arb right, so we want to secure a profit regardless of what happens, win, lose or draw in this match.

We can either now back the draw and the win on the exchange with an amount that secures a profit overall, or let it ride as is, risk-free.

With the given odds, we could place a bet of around £30 on both the Netherlands winning and the match ending a draw, this would mean we would make money regardless of the outcome.

Finding An Arb Is The Hard Part

Spending the time to find an arbitrage opportunity is worth it, it’s much easier, however, when a market goes in play, but does have a bit more risk than too.

Another way of arbing is to use bookmakers sign up bonuses or free bets, use the free bet on your chosen market, and then go onto Betfair and lay the same bet, securing a profit (known as bonus bagging)

Arbitrage Calculator

Here is a free arbitrage calculator for you to use; it will help you find arbitrage opportunities.